Most important EU regulations in the area of business sustainability

Intro

Over the past few years, the EU institutions have been developing a comprehensive policy agenda on sustainability. Today it includes a sweeping range of measures to encourage a rapid growth of sustainable business, which will enable the green transformation of the economy leading to a region-wide Net Zero status by 2050.

In this section we will go through:

- The EU Green Deal

- EU Taxonomy

- Non-Financial Reporting Directive (NFRD) and the new proposal

- Environmental regulations: Circular economy, Green public procurement, Carbon border adjustment mechanism

- Social sustainability regulations: Social Taxonomy, Corporate Sustainability Due Diligence, General Data Protection Regulation (GDPR)

- Governance related regulations: OECD principles, Whistleblowing Directive 2021

- Why business needs to start acting now?

- Check-list for your first steps

In 2019, the European Commission launched the European Green Deal, a package of actions to reduce greenhouse gas emissions and to minimize the use of resources while achieving economic growth. It focuses on climate action, clean energy, sustainable industry, efficient buildings, clean transportation, green food production, eliminating pollution, preserving biodiversity, and several other areas.

- What is it: package of actions to reduce greenhouse gas emissions and to minimize the use of resources while achieving economic growth

- What is the ultimate goal: help EU become the first climate neutral continent by 2050

- What are the benefits: cleaner environment, more affordable energy, smarter transport, new jobs, and an overall better quality of life.

Who will be impacted? All businesses, including individuals, companies, banks, business organizations, civil society organizations, trade unions, and both national and regional institutions.

What you need to know:

• This will likely impact trade within and imports to the EU.

• It is possible that environmental and sustainability standards will become stricter at a later stage.

• This will mean more requirements for businesses from developing countries that export to the EU.

• Many decisions will be taken in the coming two years, and these decisions will determine the extent of the impact on business.

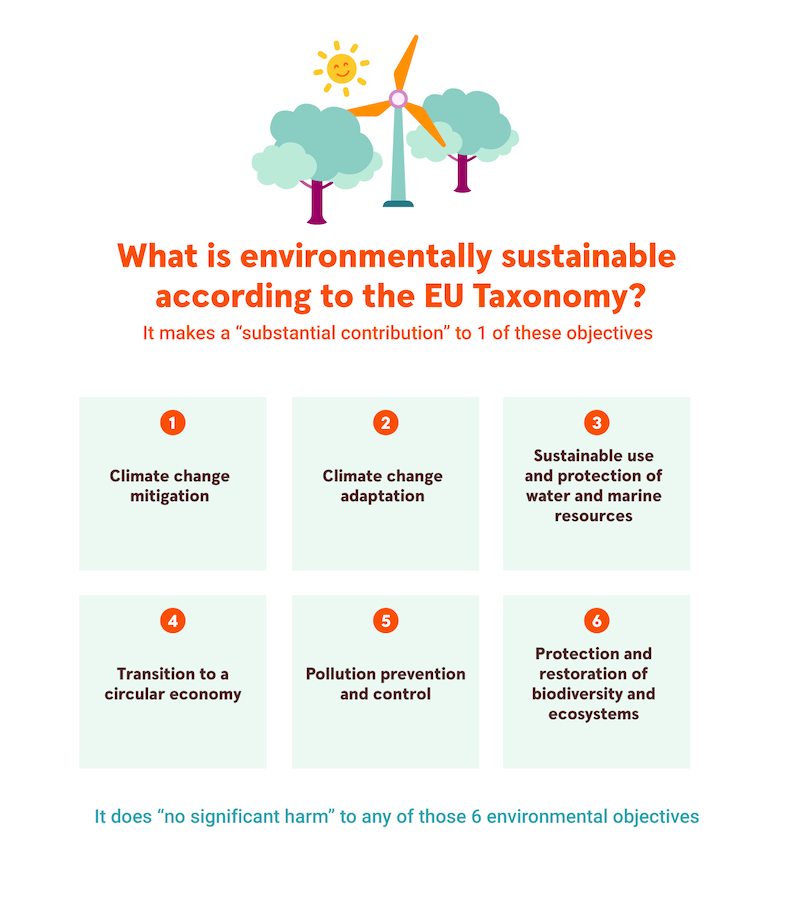

The EU Taxonomy (Taxonomy) acts as a backbone for to the European Green Deal. It provides a framework for classifying environmentally sustainable activities. It came into effect on 1st January 2022.What is the goal: increase transparency and provide clear guidance on the activities and investments that are considered to be sustainable.

Who is currently affected directly:

- Companies over 500 employees, that fall under the non-financial reporting directive (NFRD)

- Financial entities

- EU and its member states

The company also needs to avoid violation of minimum “social safeguards”, i. e. not cause adverse social impacts.

What sustainability criteria are set for different sectors?

You can see the criteria in the EU Taxonomy Compass | European Commission (europa.eu). Currently not all sectors are included, but this is work in progress.

The NFRD is an EU law requiring large companies to disclose certain information on the way they operate and manage social, environmental and governance challenges.What is the goal: encourage companies to develop a responsible approach to business and be more transparent, helping investors, consumers and other stakeholders to evaluate their non-financial performance.

To whom it is currently applied: “public interest entities”, meaning banks, insurance, listed and other companies, meeting 2 out of 3 following criteria: more than 500 employees; turnover of more than €40 million; balance sheet assets greater than €20 million.

Currently there is no universal standard for non-financial reporting, so companies use different methodologies, e.g.: the UN Global Compact; the OECD guidelines for multinational enterprises; ISO 26000.

Proposal for a Corporate Sustainability Reporting Directive

In a few yeas time NFDR will be replaced by a newly proposed Corporate Sustainability Reporting Directive (CSRD). The purpose of the CSRD is to create more harmonized requirements on what information needs to be included in the sustainability reports and sets more detailed requirements on the content. The reports will also have to be verified by third party (audited).

The reporting standard for SMEs will be of a smaller scale then those applicable for large companies. Listed micro companies and non-listed SMEs fall outside of the scope but can use CSRD on a voluntary basis.

What does it mean for the business?

The CSRD marks a major step in corporate reporting with far-reaching implications for businesses. Companies will need to devote significant time and resources to prepare for implementation of the directive — the first report will have to be published on Q1 2025 for the period starting on 1st of January, 2024. It is recommended to start preparing for CSRD already in 2022 by looking at the draft standards that are made available for public consultation.

Impact on businesses

Reputation. As the EU Taxonomy will indicate whether and to what extent a company is contributing to environmental objectives, it is likely that alignment with the EU Taxonomy will have an impact on a company’s reputation. The Taxonomy aims to provide clarity to investment professionals and protect against ‘greenwashing’ claims. Once a company discloses its alignment with the Taxonomy criteria, it will provide detailed information on the actual environmental impact and sustainable performance of its economic activities.

Access to finance. Companies will have better access to finance by disclosing their alignment with the EU Taxonomy. Financial institutions that wish to increase their share of taxonomy-aligned investments will look to invest in companies that have taxonomy-aligned activities and that have disclosed this.

Scope for improvement. By assessing economic activities with the best-practice metrics offered by the Taxonomy, companies will achieve an increased understanding of the sustainable impact of their activities. This assessment will allow them to benchmark themselves against the best practices in order to indicate where possible improvements can be made.

Compliance and resilience. The EU Taxonomy as well as CSRD will be mandatory for a significant number of European financial institutions and companies. Different disclosure regulations will be applied for a financial or non-financial company. A financial institution should disclose to what extent it uses the EU Taxonomy, to what environmental objectives its investments contribute, and the percentage of underlying investments that are EU Taxonomy-aligned. Non-financial companies are to disclose the financial metrics aligned with the EU Taxonomy, whether and how it complies with the social safeguards, and that it does not significant harm to any of the environmental objectives.

Timeline for afore mentioned regulations

Sustainability-related disclosure in the financial services sectorEU regulation on sustainability-related disclosures in the financial services sector, known as the SFDR, sets out transparency requirements for investors and financial advisers. It is in force since 2021.

Other ESG regulations relevant for the business

The acronym ESG represents environmental, social and governance areas. During recent decade its relevance grew, as investors, policy makers and society started paying more attention to companies’ impact on well-being of society and protection of environment.

The upcoming Corporate Sustainability Reporting Directive (CSRD) will bring the reporting on ESG to a new level in two respects – by increasing the number of companies which are obliged to report and by extending the scope of criteria to be reported, especially placing emphasis on climate change related factors.

EU environmental policies and legislation protect natural habitats, keep air and water clean, ensure proper waste disposal, improve knowledge about toxic chemicals and help businesses move toward a sustainable economy. Combating climate change is an explicit objective of EU environmental policy.

EU is committed to ensuring the successful implementation of the Paris Agreement and implementing the EU’s Emissions Trading System (EU ETS). EU countries have agreed to meet various targets in the years to come. The EU seeks to ensure that climate concerns are taken on board in other policy areas (e.g. transport and energy) and also promotes low-carbon technologies and adaptation measures.

Circular economy

The EU’s Circular Economy Action Plan is a set of interrelated initiatives. It aims to reduce pressure on natural resources by transforming the design, production and consumption of products, so that no waste is produced. It must be emphasized that this is a plan and not a directly acting law. Based on this plan initiatives are being developed to achieve a circular economy. These initiatives target many different materials and commodities:

- Electronics, information and communication technologies (ICT) – one of the aims is to ensure “right to repair”. Furthermore, the European Commission plans to initiate additional regulations on chargers for mobile phones and similar devices (E. g initiative of a common charger). Another important goal, which is mentioned in the plan, is EU-wide take-back scheme. This scheme's aim is to return or sell back old electronic devices, such as chargers, tablets and mobile phones.

- Batteries and vehicles – several important upcoming initiatives can be mentioned. One of them is to consider the use of non-rechargeable batteries and gradually replace them with alternatives. Another goal is that the European Commission seeks to guarantee sustainability and transparency requirements for batteries.

- Packaging – the Commission will review the requirements on packaging and packaging waste in the EU and it is expected that the proposal will be published by the end of first quarter of 2022. This will include assessing how to improve packaging design to promote reuse and recycling; increase recycled content in packaging; tackle excessive packaging; reduce packaging waste.

- Plastics – the European Commission started tackling the problem of microplastics. EU rules on single-use plastic products aim to prevent and reduce the impact of certain plastic products on the environment, in particular the marine environment, and on human health. They also aim to promote the transition to a circular economy with innovative and sustainable business models, products and materials, therefore also contributing to the efficient functioning of the internal market.

- Textiles – one of the aims is to improve regulatory environment for sustainable and circular textiles. The European Commission is planning to provide support for sustainable textile businesses. It aims to ensure that the textile industry recovers from the COVID-19 crisis in a sustainable way by making it more competitive; applying circular economy principles to production, products, consumption, waste management and secondary raw materials; directing investment, research and innovation.

- Construction and buildings – The European Commission notes that recycled content requirements for certain construction products may be introduced in the future. In addition, life cycle assessments could be used in public procurement.

- Food, water and nutrients – initiatives might focus on substituting single-use products (E. g tableware).

Green public procurement

Green Public Procurement is defined as a process whereby public authorities seek to procure goods, services and works with a reduced environmental impact.

Green public procurement is mostly voluntary, but European Commission plans to introduce mandatory green public procurement in certain sectors:

- Transport. The Clean Vehicles Directive aims to increase the share of low- and zero-emission vehicles in contracts tendered by public authorities. Public authorities will have to promote and purchase alternative technologies, including vehicles running on electricity, natural gas and hydrogen. Each EU country would decide specific targets on a national level.

- Batteries. European Commission has introduced EU Batteries regulation proposal. The draft proposal aims to ensure that all batteries placed on the EU market are sustainable, circular, and safe. Once passed, these regulations will require new circular partnerships between battery manufacturers and recyclers. The regulation should be adopted by the end of 2022 and be included into green procurement by 2027.

- Sustainable products initiative. This aims to make products placed on the EU market more sustainable. Consumers, the environment and the climate will benefit from products that are more durable, reusable, repairable, recyclable, and energy-efficient. The initiative will also introduce green public criteria and address the presence of harmful chemicals in products such as electronics & ICT equipment; textiles; furniture; steel, cement & chemicals.

- Reducing packaging waste. This will include assessing how to improve packaging design to promote reuse and recycling; increase recycled content in packaging; tackle excessive packaging; reduce packaging waste.

The use of green public procurement criteria will affect not only public purchasers, but also suppliers and manufactures.

Lithuania has even more ambitious goal – it is expected that by the end of 2023, all public procurement will be green. The indicator of green public procurement is one of the strategic goals of the Government program. Achieving the green public procurement goals set in the Government program will require a drastic change in the way public bodies carry out public procurement procedures.

For this reason, Ministry of Environment updated definition of green public procurement, updates green public procurement criteria and their procedures focusing on the newest product and service requirements, related to energy and resource efficiency and climate effect, as well as extend the list of product groups to which the green public procurement criteria can be applied. Moreover, in certain cases, public bodies may create green criteria based on principles established in the order of the minister of environment.

Carbon border adjustment mechanism

Carbon Border Adjustment Mechanism (CBAM) will put a carbon price on imports of these products – iron, steel, cement, fertilizer, aluminum and electricity generation. If European Parliament approves it, CBAM will become operational in 2026. From 2023 until 2026 will be a transitional phase, when EU importers will only have to report emissions embedded in their goods.

What is the goal: The CBAM mechanism purpose is to put extra cost on imported materials, which have high carbon footprint. Since EU manufacturers are obligated to meet higher environmental criteria, materials form external markets could become cheaper. In order to prevent this, carbon tax will be introduced.

Who is effected directly: EU importers of iron, steel, cement, fertilizer, aluminum and electricity generation.

How CBAM will work: EU importers of the mentioned products will have to purchase certificates. The price of certificate will be expressed in € / tonne of CO2 emitted and will be linked to the EU Emission Trading System (ETS).

Social Taxonomy

Platform on Sustainable Finance, a permanent expert group of the European Commission, will assist European Commission in developing “Social Taxonomy”. Social Taxonomy is related to social aspects of sustainability: human rights, equal pay, employee health and well-being, customer safety, accessibility of products, and other indicators. The combination of environmental and social taxonomies will ultimately lead to a full sustainability picture in company reporting.

Proposal for a Directive on corporate sustainability due diligence

EU-wide mandatory corporate due diligence and accountability legislation is aimed at preventing human rights abuses in business operations, ensuring respect for core labor rights and minimizing negative environmental impacts. The proposed Directive will cover not only company’s own operations, but also subsidiaries and the value chain operations carried out by suppliers.

Special attention will be dedicated to companies which operate in high-risk sectors (e.g. textile and footwear, agriculture, forestry, fisheries or extraction and trading of minerals).

The proposal will be presented to the European Parliament and the Council for approval. Once adopted, EU countries will have 2 years to transpose the Directive into national law.

General Data Protection Regulation (GDPR)

GDPR is a set of data protection rules, which enhance how people can access information about them and places limits on what organizations can do with personal data. This regulation changes the way the company does marketing and sales activities, it requires careful handling of personal customer data, internal and external data processing policies, designated officers for ensuring the compliance.

Additional sources:

https://ec.europa.eu/info/law/law-topic/data-protection/reform/rules-business-and-organisations_en

OECD principles

In 1999, the Organization for Economic Cooperation and Development introduced principles that became guidelines for many policymakers and investors. G20/OECD Principles are not intended to be legally binding. However, they could consider as valuable guidance for business that aims to remain competitive and attractive to potential investors.

Whistleblowing Directive 2021

The Directive means putting in place channels and procedures for internal reporting and follow-up. Protection under the Directive is granted to 'work-related' reports, i.e. those made by workers, self-employment persons, shareholders, contractors, and suppliers. Companies with 250 workers or more must comply by 2021, while entities with 50 to 249 workers must do the same by 17 December 2023.

The upcoming regulations mean that the way companies are doing business is going to change. The extent of the changes will depend on the sector and the scope of business operations. Large companies will be affected most at first. However, in the foreseeable future all companies will have to play a role in green transformation of the economy due to regulations, pressure from partners or stakeholders, changing attitudes of clients and employees.Opportunities for your business

Top-line growth. A strong ESG proposition helps companies tap new markets and expand into existing ones. When governing authorities trust corporate actors, they are more likely to award them the access, approvals, and licenses that afford fresh opportunities for growth.

Reduced risks. A stronger external-value proposition can enable companies to achieve greater strategic freedom, easing regulatory pressure. In fact, in case after case across sectors and geographies, we’ve seen that strength in ESG helps reduce companies’ risk of adverse government action.

Talent attraction. A strong ESG proposition can help companies attract and retain talented employees, enhance employee motivation by instilling a sense of purpose, and increase productivity overall. Employee satisfaction is positively correlated with shareholder returns.

Investment opportunities. A strong ESG proposition can enhance investment returns by allocating capital to more promising and more sustainable opportunities (for example, renewables, waste reduction, and scrubbers). It can also help companies avoid stranded investments that may not pay off.

- Based on your company profile, size and sector, check which of the upcoming EU regulations will be relevant for you.

- Some EU regulations, which you will find relevant, are still in progress. E.g. they are undergoing public consultation stage or are still under discussions. Keep an eye on the progress to catch updates, which might be relevant for your company.

- Keep in mind that some EU regulations become mandatory for EU countries straightway and some need to be localized into national law. Keep an eye on the timelines.

- Start preparing for new regulations beforehand. Some of them may require detailed internal analysis, new processes, additional resources. You will be more comfortable with it if you have more time to prepare.

- Consider the possibility to prepare your own sustainability report, even it’s not yet mandatory to you. This will be good practice and will also help you map all sustainability related topics relevant for your company.